Sorry, but this will be a boring newsletter strictly about real estate, no jokes or funny stories this time.

In the past, we mainly wrote about the real estate market in San Mateo County, but going forward, we are merging the data for both counties and discussing them together. Over the years, the data for these counties has increasingly aligned in terms of pricing and housing demand. Currently, the average single-family home price in both counties is approximately $2,500,000, with prices per square foot at $1,242 in San Mateo and $1,259 in Santa Clara.

Let’s take a closer look at what’s happening in the single-family home markets of San Mateo and Santa Clara Counties.

Stock Market Chaos

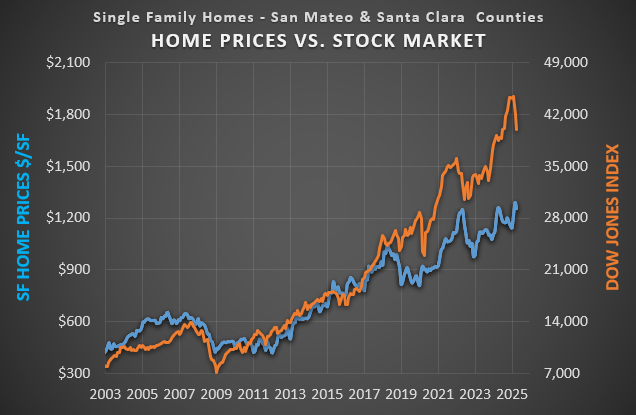

The stock market has been on a wild ride in April 2025. The Dow Jones Index (DJI) dipped as much as 16% below its January highs and recently settled around 10% below those levels. Typically, single-family home prices in Santa Clara and San Mateo counties follow stock market trends. However, for April 2025, home prices have largely remained unaffected by the decline in stock values. The average price of homes closing escrow in April was $2,557,133, down slightly from the March peak of $2,662,815—a 2.6% decrease in value per square foot since last month.

The big question is whether home prices might soon decline as well? Looking at the chart, it appears that the rise in the stock market in 2024 outpaced home values, and the recent decline in the DJI back to early 2024 levels suggests home prices could follow suit. For that correlation to continue, either home prices would have to rise sharply in 2025, or the stock market would need to rebound.

However, in April 2025, we also saw a sharp drop in what should be normal demand for available homes—more on that later in this article.

New Listings, Pendings & Actives

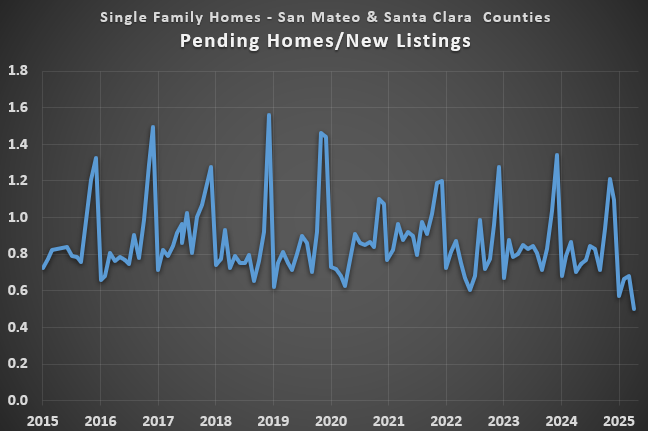

There’s a seasonal pattern in real estate: more homes come on the market in spring and summer than in fall and winter. To account for this, we’ll compare April 2025 with previous Aprils. That graph above compares stats for the month of April over the past 11 years.

This year, the number of new listings (yellow line) increased significantly over the past couple of years, but it’s now returning to a more normal level. Before the interest rate spike in mid- 2022, April typically saw about 2,000 new single-family homes listed. In April 2023, there were only 1,257, and in April 2024, 1,662. Many sellers hesitated to list their homes because they were reluctant to give up low-interest mortgages on their current homes and face higher rates on new ones. In April 2025, there were 2,010 new listings—more in line with the last decade, except for 2020 during COVID and 2023 after the rate spike.

Active listings are also on the higher side, currently totaling 2,082 homes. While not surpassing previous peaks over the past 10 years (see the blue line), we’re approaching those levels. When active listings have been at these higher levels, it did represent a shift towards a market that favored buyers.

The slowdown is due to decreased demand. Although new listings have added to inventory, we expected about 1,400 homes to go pending in April 2025—yet only 1,003 did. Many agents, including ourselves, have buyers pausing their searches, waiting for more economic clarity.

This reduced demand is also evident in the number of homes sold in April. Only 1,165 homes closed escrow (orange line), about 20% below what’s typical in a strong seller’s market given the inventory levels.

The ratio of pending homes to new listings is at a historic low—only 0.50 in April 2025. This means roughly that only half of the new listings found buyers, a figure not seen in the past decade (see the blue line in the graph above).

Homes that closed escrow in April were on the market for an average of 16 days, selling for about 6.4% above asking price which suggests a good market for sellers. These homes mostly went pending in March. Homes pending at the end of April had been on the market for an average of 20 days, four days longer than those that already closed.

Currently, active listings have been on the market for about 40 days—slightly longer than usual, which indicates softening demand.

Buyer Behavior

Despite these statistics demonstrating softening demand, many properties still sold with multiple offers for well above asking price this past week. The limited supply in 2023 and 2024 has left some frustrated buyers still in the market, undeterred by economic chaos and higher interest rates. Some buyers see current conditions as an opportunity, but competition remains strong for higher-quality homes in the right neighborhoods. Meanwhile, less desirable properties are lingering.

What to do?

Sellers: For about half of you, this is still a good time to sell your home. The key is to understand demand in your neighborhood and for your specific property, considering all its characteristics—location, condition, layout, architecture, lot topography, etc. Your home might be one of those still in high demand. It might be a good time to make the move, especially if your next purchase is in a location that favors buyers at the moment.

For the other half that own homes in locations with softening demand, if you need to sell, then make your home as turnkey and attractive as possible for a reasonable budget. Put on that fresh coat of paint, install new carpet, replace older light fixtures, repair broken items, and stage the home if possible.

What we don’t know is whether there is more downside risk in the near future or potential upside to waiting. The size and extent of these tariffs are unprecedented, and the true impact of increasing costs has yet to be fully felt.

Buyers: This could be a good buying opportunity. There is always the possibility of further price drops that you might miss out on if you purchase now. However, there’s also a chance that some favorable trade deals, reducing tariffs to reasonable levels, could cause the stock market to rebound overnight—potentially reigniting high housing demand. Could you get priced out if that happens? That’s the classic risk/reward dilemma.

Selling or buying a home in San Mateo or Santa Clara?

Seek people who will put their full effort into representing your interests, treat you like a person and not a transaction, and experts who are well-respected in their profession. With over 30 years of combined experience and 95% of their clients coming from referrals, we take great pride and joy in exceeding your expectations.