First, lets start off with a New Year salutation. We at Vabrato hope that 2026 will be a happy, healthy and successful year for our clients, friends, family and anyone reading this newsletter.

Too busy to read the whole letter, then here is the summary: 2025 was a boring year for real estate. Things just kind of stayed the same while new listings increased by a small amount. That’s about it, but if you want to get into the weeds, then read on.

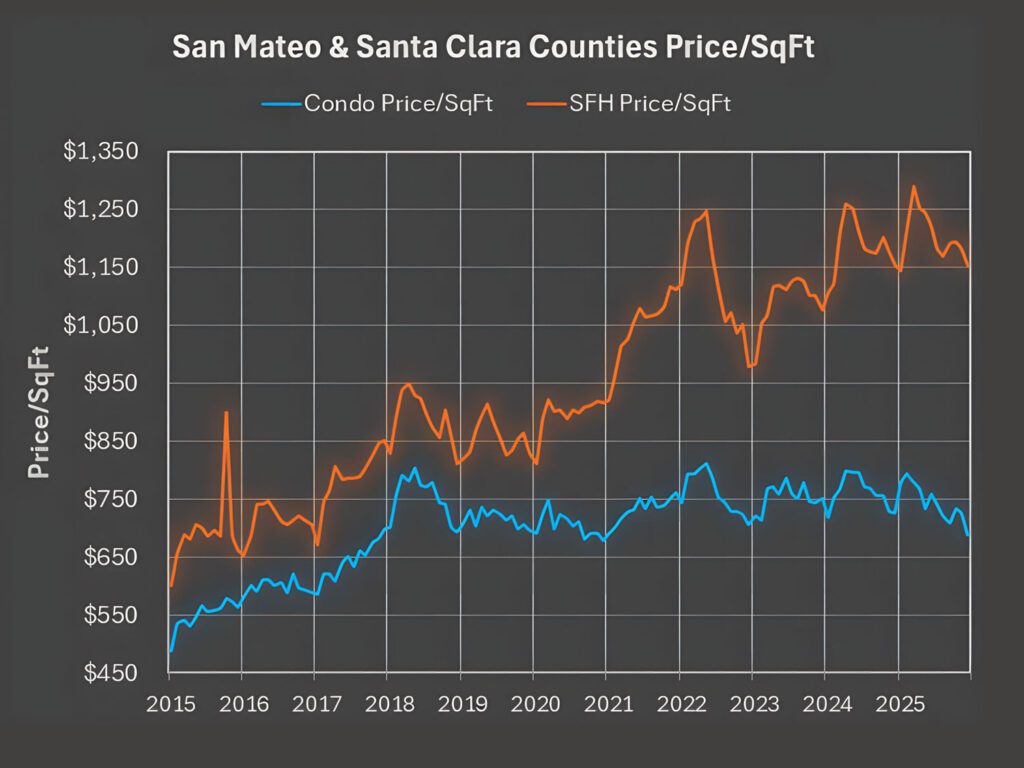

SINGLE FAMILY PRICES VS CONDOS

2025 was essentially a flat year for single-family home (SFH) prices in Santa Clara and San Mateo Counties. As expected, prices experienced a seasonal bump in the spring, but the year both began and ended at approximately $1,150 per square foot of living space. The average single-family home sold for $2,420,000, nearly identical to 2024.

In fact, 2024 and 2025 tracked almost identically. Both years started and ended around $1,150 per square foot and peaked in the spring. In 2024, prices peaked at $1,259 per square foot, compared to $1,289 per square foot in 2025; levels very close to the 2022 peak before rising interest rates pushed prices lower.

While single-family home prices finished flat, condos declined meaningfully, ending 2025 down approximately 13% per square foot. By December 2025, the average condo price across both counties was $829,000.

Overall, condos continue to underperform single-family homes. Since 2020, single-family home prices have increased approximately 41%, while condos have risen only 5.7%. Many condo owners are seeing values roughly in line with 2019 levels, while single-family homes surged ahead.

We’ve previously described this as a “quadruple whammy” for condos:

- COVID shifted buyer preferences away from high-density housing.

- Insurance premiums skyrocketed, driving HOA fees sharply higher.

- SB 326 mandated inspections and repairs of elevated wood structures in condos (e.g., balconies), uncovering significant deferred maintenance, leading to special assessments and higher HOA fees. During these repairs, many lenders paused condo financing, sometimes for months.

- Interest rates spiked in 2022, and condo buyers—typically more rate-sensitive—were hit hardest by the combination of higher HOA fees and higher borrowing costs.

Our view: Condos are likely to see renewed appreciation once these issues fade—ownership costs stabilize, lending becomes easier, and mortgage rates move closer to 5%. Given the ongoing housing shortage, it’s difficult to justify a long-term scenario where single-family homes continue rising while other housing types remain flat.

Despite flat pricing in 2025, multiple-offer situations still occurred, though less frequently. They were largely limited to exceptional properties or homes priced aggressively below market.

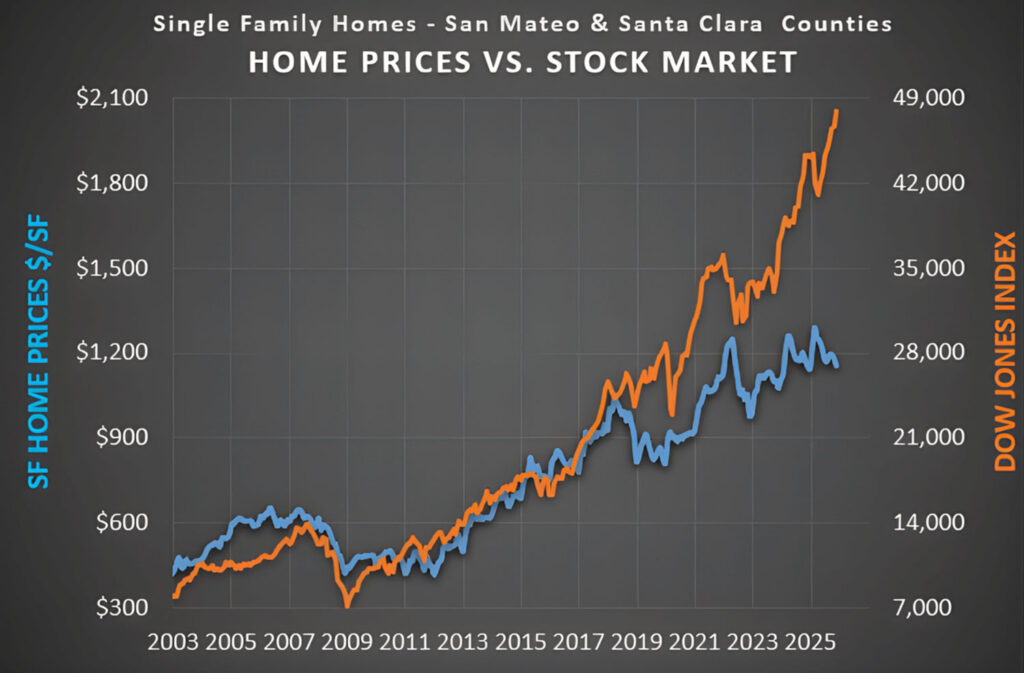

SINGLE FAMILY PRICES VS STOCKS

Meanwhile, the relationship between home prices and stock indexes has diverged. Since the start of 2024, the Dow Jones Industrial Average is up approximately 26%, while single- family home prices increased only about 4% over the same period.

The Nasdaq-100 has outperformed home prices even more dramatically—up roughly 70% since early 2024, compared to the same 4% gain in home prices.

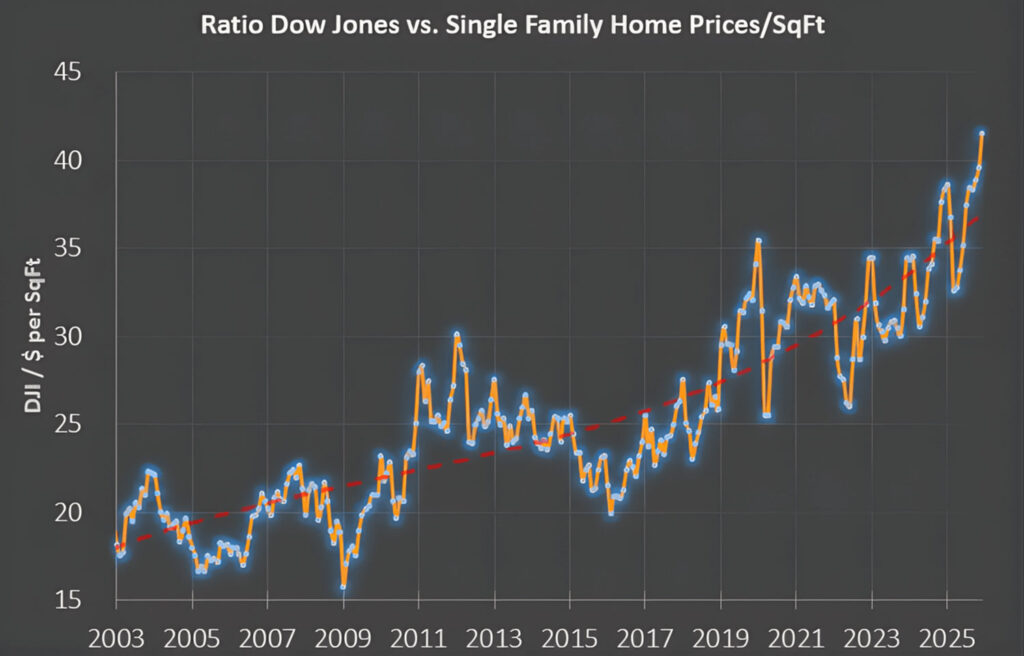

In 2003, the Dow Jones Index was roughly 18 times the average price per square foot of a single-family home. Today, that ratio is closer to 43 times, highlighting how stock indexes have appreciated far faster than home prices over time.

That said, homeownership is a leveraged investment, while most investors do not buy stocks on margin. For example, if you put $500,000 down on a $2.5M home and prices rise 5%, that’s a $125,000 gain, or 25% on your cash investment. By contrast, a $500,000 stock investment rising 5% yields just $25,000.

Once a home is largely paid off, that leverage diminishes. At that point, returns must be evaluated relative to the full asset value—where stocks have historically outperformed home appreciation.

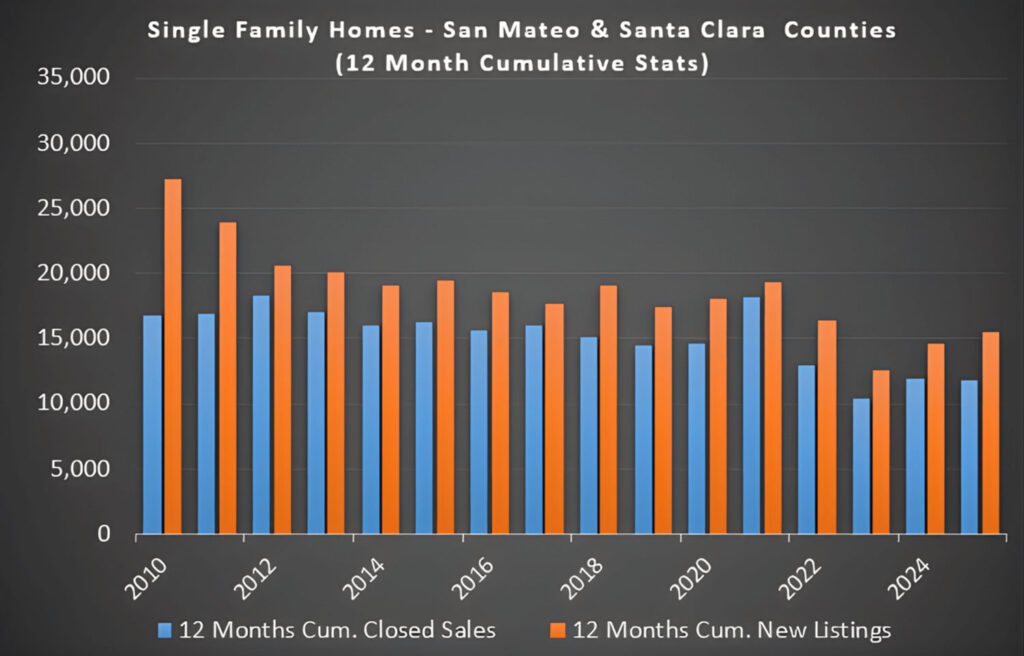

SINGLE FAMILY SALES VS LISTINGS

Sales activity in 2025 closely mirrored 2024, with 11,896 homes sold versus 11,806 the prior year. However, the market was slightly slower because nearly 1,000 more homes were listed in 2025 (15,495 vs. 14,589).

In 2025, sales represented 76% of new listings, compared to 82% in 2024. New listings have been rising gradually since their sharp drop in 2023, when interest-rate hikes discouraged sellers who didn’t want to give up ultra-low mortgage rates.

INTEREST RATES

The good news is that 2025 ended with lower mortgage rates than it began. Rates started the year around 6.85% and closed near 6.15%—still well above the sub-3% levels of 2021.

Many industry observers believe the “magic number” to unlock more seller and buyer activity is a 30-year fixed rate at or below 5%.

WHAT DOES IT ALL MEAN?

In short, both buyers and sellers have been sitting on the fence.

Sellers hesitate to move because selling often means buying again at a higher rate—and potentially paying significant capital-gains taxes after years of appreciation.

Buyers, meanwhile, are waiting for either lower rates or lower prices, and some are cautious amid concerns about AI-driven job disruption or a potential stock-market correction.

WHAT TO DO HERE?

Ultimately, it’s a risk-versus-reward decision.

For buyers, taking your time in today’s market can work—but it can also backfire. We’ve seen markets shift from cold to hot almost overnight. If demand suddenly increases, affordability may worsen. While you can refinance if interest rates fall, you can’t renegotiate the purchase price later. That said, today’s market does allow buyers to proceed a bit more cautiously and, in some cases, negotiate concessions on less competitive or less desirable properties. Historically, purchasing a single-family home and holding it for a decade or longer has proven to be a solid long-term decision.

For sellers looking to downsize, this is an attractive window. You’re selling near all-time high price levels. If home values continue to rise after downsizing, your smaller replacement home is likely to appreciate as well, while any well-invested excess proceeds can continue to grow. If prices decline after the move, you’ve still benefited by selling your larger home near its peak. In this scenario, the greater risk typically lies with equity market exposure, not housing.

Overall, we believe there may be more downside risk in waiting to sell than upside, given increasing uncertainty around equity markets and ongoing affordability challenges. While stock markets have remained resilient, there are clear headwinds—from trade pressures to rising import costs—and affordability constraints are becoming more pronounced. Despite the recent divergence between stock performance and home prices, a meaningful stock market correction would likely put downward pressure on housing values as well.